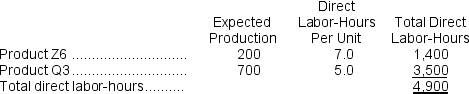

Mattioli, Inc., manufactures and sells two products: Product Z6 and Product Q3.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below:  The direct labor rate is $21.00 per DLH.The direct materials cost per unit for each product is given below:

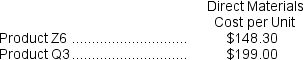

The direct labor rate is $21.00 per DLH.The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

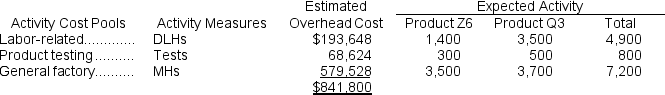

The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  Required:

Required:

In all computations involving dollars in the following requirements, round off your answer to the nearest whole cent.

a.Compute the activity rates under the activity-based costing system.

b.Determine how much overhead would be assigned to each product under the activity-based costing system.

c.Determine the unit product cost of each product under the activity-based costing method.

Definitions:

Jeweller

A specialized professional or establishment in the business of selling, crafting, and repairing jewelry.

Canadian Polar Bear Diamonds

High-quality diamonds sourced from specific mines in Canada, known for their ethical sourcing and purity.

Trade Discount

A reduction from the listed price of goods or services offered to buyers in the business-to-business market to encourage purchase in larger quantities.

Real Estate Commission

The fee, typically a percentage of the sale price, paid to a real estate agent for their services in selling a property.

Q35: Macfarlane, Inc., manufactures and sells two products:

Q69: Which of the following statements concerning the

Q80: The total job cost for Job K818

Q83: Crimp Corporation uses the FIFO method in

Q89: Assigning manufacturing overhead to a specific job

Q99: Ibarra Corporation uses the FIFO method in

Q107: Weiskopf, Inc., manufactures and sells two products:

Q170: The overhead applied to each unit of

Q193: Batch-level activities are performed each time a

Q219: How much is the adjusted cost of