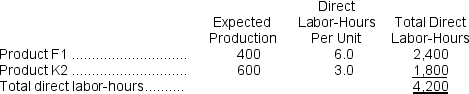

Brayman, Inc., manufactures and sells two products: Product F1 and Product K2.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below:  The direct labor rate is $28.30 per DLH.The direct materials cost per unit is $148.60 for Product F1 and $192.70 for Product K2.

The direct labor rate is $28.30 per DLH.The direct materials cost per unit is $148.60 for Product F1 and $192.70 for Product K2.

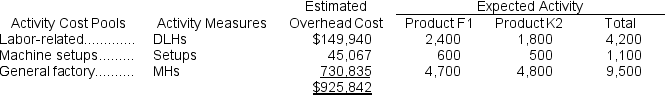

The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  Required:

Required:

Determine the unit product cost of each product under the activity-based costing method.

Definitions:

Q12: The cost per equivalent unit for materials

Q18: The cost per equivalent unit under the

Q39: Using the FIFO method, the equivalent units

Q45: How much cost, in total, was assigned

Q53: Claus Corporation manufactures a single product and

Q100: The unit product cost for Job M825

Q115: The following journal entry would be made

Q129: The following data were taken from the

Q130: The amount of overhead applied to Job

Q144: Forbes Corporation uses a predetermined overhead rate