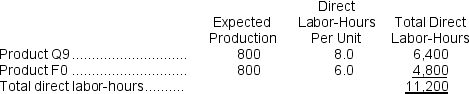

Mahaley, Inc., manufactures and sells two products: Product Q9 and Product F0.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $21.80 per DLH.The direct materials cost per unit for each product is given below:

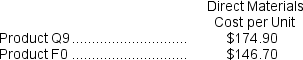

The direct labor rate is $21.80 per DLH.The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

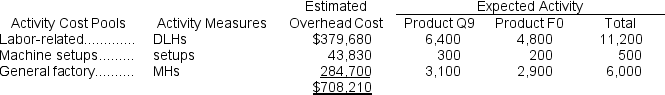

The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  The unit product cost of Product F0 under activity-based costing is closest to:

The unit product cost of Product F0 under activity-based costing is closest to:

Definitions:

Unemployment Insurance Program

A government initiative that provides financial support to eligible individuals who are unemployed through no fault of their own.

Q3: The manufacturing overhead is:<br>A)$26,000 Underapplied<br>B)$4,000 Underapplied<br>C)$4,000 Overapplied<br>D)$26,000

Q14: What would be the competitor's prediction of

Q50: How many units were started into production

Q61: The unit product cost of Product I9

Q73: The following accounts are from last year's

Q77: If the company allocates all of its

Q163: Salvatori, Inc., manufactures and sells two products:

Q164: The activity rate for the Labor-Related activity

Q185: The following cost data relate to the

Q201: The unit product cost of Product B7