(Appendix 2A) Adelberg Corporation makes two products: Product A and Product B. Annual production and sales are 500 units of Product A and 1,000 units of Product B. The company has traditionally used direct labor-hours as the basis for applying all manufacturing overhead to products. Product A requires 0.4 direct labor-hours per unit and Product B requires 0.2 direct labor-hours per unit. The total estimated overhead for next period is $68,756.

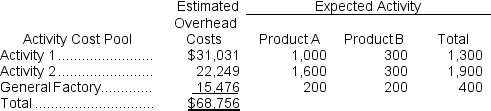

The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports. The new activity-based costing system would have three overhead activity cost pools--Activity 1, Activity 2, and General Factory--with estimated overhead costs and expected activity as follows:

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

-The predetermined overhead rate (i.e.,activity rate) for Activity 2 under the activity-based costing system is closest to:

Definitions:

Largest Share

This refers to the highest percentage of ownership or control in a company or market held by a single entity.

Germany

A country in Central Europe, known for its rich history, cultural heritage, and as a key economic and political power in the European Union.

Comparative Advantage

is the ability of an individual, company, or country to produce a good or service at a lower opportunity cost than competitors.

Specialization And Trade

The economic practice where individuals or countries focus on producing specific goods or services and trade them for others, enhancing efficiency and productivity.

Q15: In the Excel, or spreadsheet, approach to

Q56: Departmental overhead rates may not correctly assign

Q101: The journal entry to record the allocation

Q105: Greenham Corporation uses the weighted-average method in

Q127: Rodenberger Corporation has provided the following data

Q139: The cost per equivalent unit for conversion

Q166: If the company allocates all of its

Q190: A bill of materials is a document

Q214: Leelanau Corporation uses a job-order costing system.The

Q223: The ending Work in Process account balance