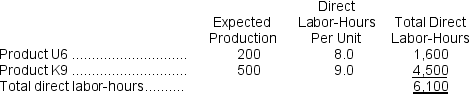

Rutty, Inc., manufactures and sells two products: Product U6 and Product K9.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below:  The direct labor rate is $28.70 per DLH.The direct materials cost per unit for each product is given below:

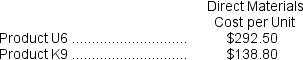

The direct labor rate is $28.70 per DLH.The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

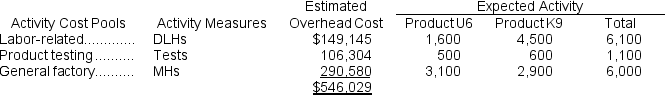

The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  Required:

Required:

In all computations involving dollars in the following requirements, round off your answer to the nearest whole cent.

a.Determine the unit product cost of each product under the company's traditional costing method.

b.Determine the unit product cost of each product under the activity-based costing method.

Definitions:

Vomiting

The forceful expulsion of stomach contents through the mouth, often resulting from nausea or illness.

-Globin

A suffix referring to a group of proteins, such as hemoglobin, that contain heme and bind or transport oxygen.

Protein

Large biomolecules consisting of one or more long chains of amino acid residues, crucial for biological processes.

Hernia

A condition characterized by the protrusion of an organ through the wall of the cavity that normally contains it, often causing pain and swelling.

Q8: Using the high-low method, the variable cost

Q14: Pine Publishing Corporation uses a predetermined overhead

Q15: The best estimate of the total contribution

Q34: The adjusted cost of goods sold that

Q49: Property taxes are an example of a

Q64: Ricardo Corporation uses the FIFO method in

Q100: Hache Corporation uses the weighted-average method in

Q101: In the department's cost reconciliation report for

Q200: Assume that the company uses departmental predetermined

Q205: The overhead applied to each unit of