Alberta Corporation uses a job-order costing system.The following data relate to the just completed month's operations.

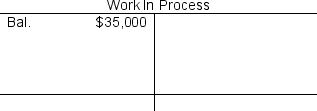

(1)Direct materials requisitioned for use in production, $170,000

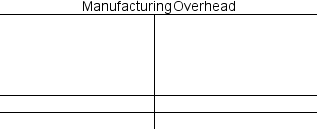

(2)Indirect materials requisitioned for use in production, $11,000

(3)Direct labor wages incurred, $105,000

(4)Indirect labor wages incurred, $103,000

(5)Depreciation recorded on factory equipment, $38,000

(6)Additional manufacturing overhead costs incurred, $63,000

(7)Manufacturing overhead costs applied to jobs, $200,000

(8)Cost of jobs completed and transferred from Work in Process to Finished Goods, $450,000

Required:

a.Where appropriate, post the above transactions to the Work in Process and Manufacturing Overhead T-accounts below.

b.Determine the underapplied or overapplied overhead for the month.

b.Determine the underapplied or overapplied overhead for the month.

Definitions:

Financial Statements

Documents that provide an overview of a company's financial condition, including its income, expenses, profit, and assets.

Responsible Party

The individual or entity legally obligated or liable for something, particularly in the context of a legal contract or wrongful act.

Standard of Care

The degree of prudence and caution required of an individual who is under a duty of care, often defined by the legal standard to avoid or minimize risk.

Director

An individual elected by shareholders or appointed to govern and oversee the management of an organization or corporation's affairs.

Q79: Beat Corporation uses a job-order costing system

Q119: The predetermined overhead rate for the Finishing

Q165: Assume that the company uses departmental predetermined

Q166: Conversion cost equals product cost less direct

Q186: If the company allocates all of its

Q193: Assume that the company uses a plantwide

Q251: How much is Kapanga's cost of goods

Q257: Fillmore Corporation uses a job-order costing system

Q279: Fixed costs expressed on a per unit

Q294: The amount that a manufacturing company could