Dagostino Corporation uses a job-order costing system. The following data relate to the just completed month's operations.

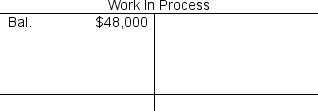

(1) Direct materials requisitioned for use in production, $154,000

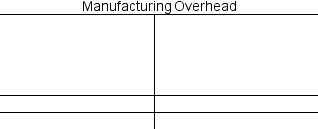

(2) Indirect materials requisitioned for use in production, $45,000

(3) Direct labor wages incurred, $94,000

(4) Indirect labor wages incurred, $119,000

(5) Depreciation recorded on factory equipment, $44,000

(6) Additional manufacturing overhead costs incurred, $83,000

(7) Manufacturing overhead costs applied to jobs, $236,000

(8) Cost of jobs completed and transferred from Work in Process to Finished Goods, $458,000

Where appropriate, post the above transactions to the Work in Process and Manufacturing Overhead T-accounts below.

-The total amount of manufacturing overhead actually incurred was:

Definitions:

Delivery

The act of transporting or conveying an item from one location to another, also applicable in contexts such as speech where it refers to the manner of presenting information.

Ineffective Listening

A poor communication practice where the listener fails to fully receive or understand the speaker's message, leading to misunderstandings.

Uninterested

Feeling no interest, concern, or enthusiasm towards a particular topic or matter.

Q29: The total job cost for Job M381

Q47: If the company allocates all of its

Q60: Latiker, Inc., manufactures and sells two products:

Q64: Thrall Corporation uses a job-order costing system

Q99: Ibarra Corporation uses the FIFO method in

Q100: Emigh Corporation's cost of goods manufactured for

Q156: The net operating income is:<br>A)$892,750<br>B)$765,750<br>C)$546,750<br>D)$1,111,750

Q157: The amount of overhead applied in the

Q171: If the company marks up its manufacturing

Q213: Flyer Corporation manufactures two products, Product A