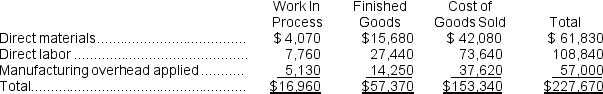

Stockman Inc. has provided the following data for the month of November. There were no beginning inventories; consequently, the direct materials, direct labor, and manufacturing overhead applied listed below are all for the current month.

Manufacturing overhead for the month was overapplied by $1,000.

Manufacturing overhead for the month was overapplied by $1,000.

The company allocates any underapplied or overapplied manufacturing overhead among work in process, finished goods, and cost of goods sold at the end of the month on the basis of the overhead applied during the month in those accounts.

-The journal entry to record the allocation of any underapplied or overapplied manufacturing overhead for November would include the following:

Definitions:

Subsidiary's Income

The earnings generated by a company that is more than 50% owned by another company, referred to as the parent company.

Straight Line Amortization

A method of writing off the cost of an intangible asset evenly over its useful life.

Equity Method

An accounting approach used to assess the investment in another company, where the investment is initially recorded at cost and subsequently adjusted to reflect the investor's share of net assets and recorded earnings of the investee.

Impairment Test

An examination to determine if an asset's carrying amount exceeds its recoverable amount, and if so, to measure the amount of impairment loss.

Q8: During May, Sharpton Corporation recorded the following:

Q31: The estimated total manufacturing overhead is closest

Q90: Molash Corporation has two manufacturing departments--Machining and

Q103: The activity rate for the Labor-Related activity

Q132: Mattioli, Inc., manufactures and sells two products:

Q158: The unit product cost of Product N0

Q166: The manufacturing overhead for the year was:<br>A)$6,000

Q167: Job cost sheets contain entries for actual

Q181: Firlit Corporation incurred $69,000 of actual Manufacturing

Q253: Carcana Corporation has two manufacturing departments--Machining and