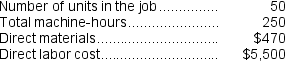

Coates Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours.The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $249,000, variable manufacturing overhead of $3.80 per machine-hour, and 30,000 machine-hours.The company has provided the following data concerning Job X784 which was recently completed:  If the company marks up its unit product costs by 30% then the selling price for a unit in Job X784 is closest to:

If the company marks up its unit product costs by 30% then the selling price for a unit in Job X784 is closest to:

Definitions:

Revaluation Surplus

An increase in the carrying amount of an asset to its fair value, exceeding its previously recorded nominal value, recognized directly in equity.

IFRS

International Financial Reporting Standards, which are global accounting standards for preparing financial statements.

Owners' Equity

The residual interest in the assets of a company after deducting its liabilities, representing the owner's claim against the company's assets.

Cost Method

An accounting method used for investments, where the investment is recorded at cost and adjustments are only made for impairments or additional investments, without recognizing unrealized gains or losses.

Q4: At an activity level of 7,200 machine-hours

Q16: Feuerborn Corporation uses a job-order costing system

Q22: Angeloni Corporation uses a job-order costing system

Q28: In the Excel, or spreadsheet, approach to

Q96: The following entry would be used to

Q138: Proby, Inc., manufactures and sells two products:

Q139: Coatney Inc.has provided the following data for

Q169: Bottum Corporation, a manufacturing Corporation, has provided

Q188: Fineberg, Inc., manufactures and sells two products:

Q230: If the company allocates all of its