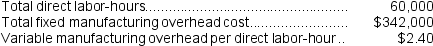

Verry Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours.The company based its predetermined overhead rate for the current year on the following data:  Recently Job X711 was completed and required 90 direct labor-hours.

Recently Job X711 was completed and required 90 direct labor-hours.

Required:

a.Calculate the estimated total manufacturing overhead for the year.

b.Calculate the predetermined overhead rate for the year.

c.Calculate the amount of overhead applied to Job X711.

Definitions:

Operating Activities

The portion of a company's cash flow statement that deals with the cash inflows and outflows from its core business operations.

Accounts Receivable

Money owed to a business by its customers for products or services delivered on credit.

Depreciation

Depreciation is the systematic allocation of the cost of a tangible asset over its useful life, representing how much of an asset's value has been used up over time.

Operating Activities Section

This section of a financial statement details the revenues and expenses directly related to the core business operations.

Q3: The manufacturing overhead is:<br>A)$26,000 Underapplied<br>B)$4,000 Underapplied<br>C)$4,000 Overapplied<br>D)$26,000

Q21: Perkey Corporation has provided the following information:

Q55: If the selling price is $20.60 per

Q84: Lezo Corporation uses a job-order costing system

Q112: Rist Corporation uses a predetermined overhead rate

Q130: The amount of overhead applied to Job

Q147: With a(n)_ variable,the values of the variable

Q168: Balerio Corporation's relevant range of activity is

Q189: How much is the total manufacturing cost

Q209: Cannizzaro Corporation uses a job-order costing system