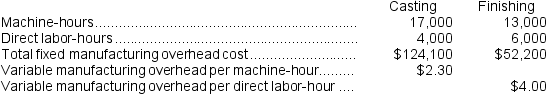

Rocher Corporation has two production departments, Casting and Finishing.The company uses a job-order costing system and computes a predetermined overhead rate in each production department.The Casting Department's predetermined overhead rate is based on machine-hours and the Finishing Department's predetermined overhead rate is based on direct labor-hours.At the beginning of the current year, the company had made the following estimates:  During the current month the company started and finished Job A394.The following data were recorded for this job:

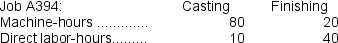

During the current month the company started and finished Job A394.The following data were recorded for this job:  Required:

Required:

a.Calculate the estimated total manufacturing overhead for the Casting Department.

b.Calculate the predetermined overhead rate for the Casting Department.

c.Calculate the amount of overhead applied in the Casting Department to Job A394.

Definitions:

Cumulative Lead Time

The total time required to manufacture a product, including the time to procure all necessary materials and components.

Component Y

A hypothetical or specific part of a larger system or machine, typically referred to in the context of manufacturing, assembly, or engineering projects.

Part Z

A hypothetical or specific component within a larger system or product, often used to discuss or analyze a particular aspect of a process or design.

Gross Material Requirements Plan

A schedule that shows the total demand for an item (prior to subtraction of on-hand inventory and scheduled receipts) and (1) when it must be ordered from suppliers, or (2) when production must be started to meet its demand by a particular date.

Q23: Vasilopoulos Corporation has two production departments, Casting

Q36: What would be the average fixed inspection

Q52: Seuell Inc.has provided the following data for

Q73: The most likely conclusion to make if

Q78: Moscone Corporation bases its predetermined overhead rate

Q84: Marquess Corporation has provided the following partial

Q85: The overhead for the year was:<br>A)$5,100 underapplied<br>B)$7,400

Q112: Rist Corporation uses a predetermined overhead rate

Q116: The total job cost for Job P951

Q219: The amount of overhead applied to Job