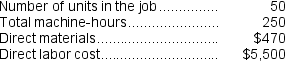

Coates Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours.The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $249,000, variable manufacturing overhead of $3.80 per machine-hour, and 30,000 machine-hours.The company has provided the following data concerning Job X784 which was recently completed:  If the company marks up its unit product costs by 30% then the selling price for a unit in Job X784 is closest to:

If the company marks up its unit product costs by 30% then the selling price for a unit in Job X784 is closest to:

Definitions:

Indirect Method

A approach used in cash flow statements to adjust net income for the effects of non-cash transactions and changes in working capital.

Operating Activities

Operating activities involve the primary revenue-generating activities of an organization, including production, sales, and delivery of the company’s product as well as administrative and general expenses.

Salaries Expense

The cost incurred by a business to pay its employees for services rendered during a specific period.

Unearned Revenues

Money received by a company for goods or services yet to be delivered or performed, recorded as a liability.

Q36: How much is the adjusted cost of

Q77: The predetermined overhead rate for the Finishing

Q111: Assume that the company uses a plantwide

Q129: Sullen Corporation uses a predetermined overhead rate

Q154: Giannitti Corporation bases its predetermined overhead rate

Q160: A cost driver is a factor, such

Q167: The adjusted Cost of Goods Sold for

Q199: If 4,000 units are sold, the total

Q202: Dallman Corporation uses a job-order costing system

Q265: To the nearest whole cent, what should