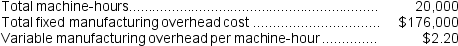

Spang Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on the following data:

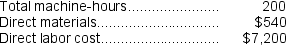

Recently, Job P505 was completed with the following characteristics:

Recently, Job P505 was completed with the following characteristics:

-The amount of overhead applied to Job P505 is closest to:

Definitions:

Household Worker

An employee who performs domestic services in a private home, such as a nanny, maid, or gardener.

Form 1040

The official form provided by the Internal Revenue Service (IRS) that people use to submit their yearly income tax returns.

Wage Bracket Method

A technique used by employers to determine the amount of federal income tax to withhold from employees' paychecks based on their earnings and filing status.

Withholding Allowances

Allowances claimed on employment forms determining the amount of federal income tax withheld from a paycheck.

Q4: Amunrud Corporation uses a job-order costing system

Q12: Huberty Corporation uses a job-order costing system

Q18: The cost of the raw materials that

Q77: The predetermined overhead rate for the Finishing

Q125: What is the total of the direct

Q135: Mcewan Corporation uses a job-order costing system

Q157: Which of the following statements concerning the

Q171: The credits to the Manufacturing Overhead account

Q211: In the Schedule of Cost of Goods

Q283: Which of the following statements is not