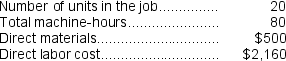

Kostelnik Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $237,000, variable manufacturing overhead of $3.90 per machine-hour, and 30,000 machine-hours. The company has provided the following data concerning Job A496 which was recently completed:

-The total job cost for Job A496 is closest to:

Definitions:

Common Stock

A type of equity security that represents ownership in a corporation, with the right to share in dividends and the right to vote in company affairs.

Fair Value

Fair value is the estimated price at which an asset or liability could be bought or sold in a current transaction between willing parties, other than in a liquidation.

Equity Method

An accounting technique used to record investments in associated companies.

Fixed Assets

Long-term tangible assets used in a company's operations, such as buildings, machinery, and equipment, which are not typically sold in the course of business.

Q5: The technique of matching to control for

Q9: Glisan Corporation's relevant range of activity is

Q11: Plocek Corporation uses a job-order costing system

Q28: Archie Corporation uses the following activity rates

Q79: If 4,000 units are sold, the variable

Q134: The term that refers to costs incurred

Q159: If a company closes any underapplied or

Q181: Assume that the company uses a plantwide

Q253: Carcana Corporation has two manufacturing departments--Machining and

Q269: Perteet Corporation's relevant range of activity is