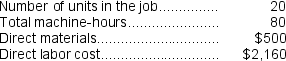

Kostelnik Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $237,000, variable manufacturing overhead of $3.90 per machine-hour, and 30,000 machine-hours. The company has provided the following data concerning Job A496 which was recently completed:

-The unit product cost for Job A496 is closest to:

Definitions:

Religion

A set of beliefs, practices, and moral codes regarding the cause, nature, and purpose of the universe, often involving a deity or deities.

National Origin

The country where a person was born, or more broadly, the country from which an individual's ancestors originate.

Private Employment Agencies

Businesses that match employers with job seekers for a fee.

Part-Time Basis

Employment where individuals work fewer hours compared to full-time positions, often with flexible schedules and sometimes without benefits like health insurance.

Q19: The salary paid to the president of

Q41: Fatzinger Corporation has two production departments, Milling

Q59: Cabio Company manufactures two products, Product C

Q71: The manufacturing overhead applied was:<br>A)$2,700<br>B)$3,000<br>C)$7,800<br>D)$13,700

Q144: Mundorf Corporation has two manufacturing departments--Forming and

Q144: The contribution format income statement is used

Q172: Ouelette Corporation's relevant range of activity is

Q221: In a manufacturing company, all costs are

Q235: Contribution margin and gross margin mean the

Q251: For financial reporting purposes, the total amount