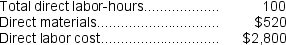

Kubes Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $90,000, variable manufacturing overhead of $3.50 per direct labor-hour, and 30,000 direct labor-hours. The company has provided the following data concerning Job A477 which was recently completed:

-The estimated total manufacturing overhead for the Assembly Department is closest to:

Definitions:

Book Value

The net value of a company's assets minus its liabilities, essentially the company's total equity.

Amortization

The gradual repayment or write-off of an asset over a specified period, typically used for loans, mortgages, or intangible assets.

Depreciation Adjustment

An accounting method used to allocate the cost of a tangible asset over its useful life, reflecting wear and tear or obsolescence.

Consolidation Purposes

Consolidation purposes involve reasons or objectives behind combining financial statements of multiple entities within a single corporate group, mainly for accurate financial reporting, analysis, and decision-making.

Q34: The adjusted cost of goods sold that

Q50: The cost of direct materials is classified

Q58: If Omar Corporation applies overhead to jobs

Q65: Helland Corporation uses a job-order costing system

Q163: Franta Corporation uses a job-order costing system

Q168: Johansen Corporation uses a predetermined overhead rate

Q180: In account analysis, an account is classified

Q202: Dallman Corporation uses a job-order costing system

Q253: The debits entered in the Raw Materials

Q297: If the selling price is $18.70 per