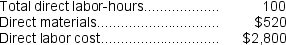

Kubes Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $90,000, variable manufacturing overhead of $3.50 per direct labor-hour, and 30,000 direct labor-hours. The company has provided the following data concerning Job A477 which was recently completed:

-The predetermined overhead rate for the Assembly Department is closest to:

Definitions:

Quad-cane

A type of walking aid with four small feet that provides greater stability than a standard single-point cane.

Ambulation

The act of walking or moving from one place to another, often used in medical contexts to describe a patient’s ability to move independently.

Left-sided Weakness

Muscle weakness or paralysis on the left side of the body, often a result of stroke or neurological damage.

Lumbar

Relating to the lower part of the spine, comprising the five vertebrae between the rib cage and the pelvis.

Q1: The amount of direct labor cost in

Q16: The applied manufacturing overhead for the year

Q35: The $10,000 balance in the T-account below

Q81: Although the traditional format income statement is

Q109: Desjarlais Corporation uses the following activity rates

Q124: Faughn Corporation has provided the following data

Q179: The gross margin for June is:<br>A)$242,600<br>B)$148,800<br>C)$124,800<br>D)$102,200

Q182: Durphey Corporation has provided the following data

Q215: The estimated total manufacturing overhead for the

Q216: During September at Renfro Corporation, $65,000 of