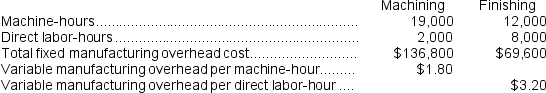

Kalp Corporation has two production departments, Machining and Finishing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Machining Department's predetermined overhead rate is based on machine-hours and the Finishing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:

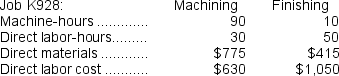

During the current month the company started and finished Job K928. The following data were recorded for this job:

During the current month the company started and finished Job K928. The following data were recorded for this job:

-The total amount of overhead applied in both departments to Job K928 is closest to:

Definitions:

Third-Country Nationals

are individuals who are employed in a country where they are neither citizens nor permanent residents, often working for multinational companies or international organizations.

Home-Country Nationals

Employees who work for a multinational company within their own country but are involved in international operations.

Parent-Country Nationals

Employees who are citizens of the country where the parent company of their employer is situated, working abroad in the company’s foreign branches.

Expatriate Training

The preparation provided to employees and their families before they go on an international assignment, focusing on cultural, language, and professional aspects.

Q1: In the Excel, or spreadsheet, approach to

Q17: Fossil Manufacturing uses a predetermined overhead rate

Q19: The salary paid to the president of

Q57: Entry (1)in the below T-account represents the

Q94: The predetermined overhead rate is closest to:<br>A)$2.40

Q100: Emigh Corporation's cost of goods manufactured for

Q131: The journal entry to record the application

Q141: The contribution margin for October is:<br>A)$1,424,500<br>B)$3,191,400<br>C)$1,901,900<br>D)$996,900

Q191: The fact that one department may be

Q239: The amount of overhead applied to Job