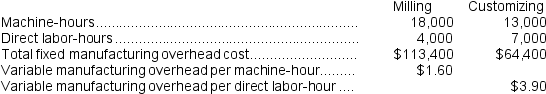

Comans Corporation has two production departments, Milling and Customizing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Milling Department's predetermined overhead rate is based on machine-hours and the Customizing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:

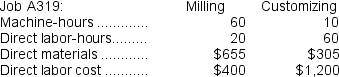

During the current month the company started and finished Job A319. The following data were recorded for this job:

During the current month the company started and finished Job A319. The following data were recorded for this job:

-If the company marks up its manufacturing costs by 20% then the selling price for Job A319 would be closest to:

Definitions:

PivotTable Tools Analyze

A set of features in spreadsheet software used to examine and manipulate data within a PivotTable for deeper insights.

Show Group

A feature in software that allows users to display or manage a collection of items or data as a single group.

Excel Tables

A structured range of data organized in columns and rows within Microsoft Excel, which can be used for easier data management, analysis, and visual representation.

Field Header Buttons

Buttons in software applications, often found at the top of columns in data tables, used to sort or filter the data beneath them.

Q17: Montuori Corporation uses a job-order costing system

Q56: Abburi Company's manufacturing overhead is 60% of

Q60: The amount of overhead applied in the

Q77: Rediger Inc., a manufacturing Corporation, has provided

Q124: Kilby, Inc., manufactures and sells two products:

Q130: The amount of overhead applied to Job

Q195: Entry (4)in the below T-account could represent

Q200: Assume that the company uses departmental predetermined

Q246: The amount of overhead applied to Job

Q279: Gilchrist Corporation bases its predetermined overhead rate