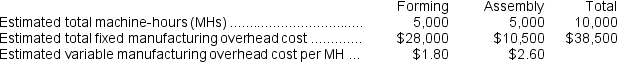

Merati Corporation has two manufacturing departments--Forming and Assembly. The company used the following data at the beginning of the year to calculate predetermined overhead rates:

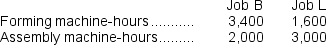

During the most recent month, the company started and completed two jobs--Job B and Job L. There were no beginning inventories. Data concerning those two jobs follow:

During the most recent month, the company started and completed two jobs--Job B and Job L. There were no beginning inventories. Data concerning those two jobs follow:

-Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments.The departmental predetermined overhead rate in the Forming Department is closest to:

Definitions:

Subsequent Depreciation

The allocation of an asset's cost over its useful life, considering any adjustments made following the asset's initial measurement and recognition.

Revaluation Method

A method used to adjust the carrying value of an asset to its current market value on the balance sheet.

IFRS

The International Financial Reporting Standards (IFRS) provide a common global language for business affairs so that company accounts are understandable and comparable across international boundaries.

Asset Exchange Transaction

A transaction where one asset is given up in exchange for another asset, with both having a measurable fair value.

Q19: Darrow Corporation uses a predetermined overhead rate

Q105: The predetermined overhead rate is closest to:<br>A)$1.80

Q111: A cost can be direct or indirect.The

Q171: If the company marks up its manufacturing

Q206: Dizzy employees a certified operator for each

Q229: The cost of direct materials used is:<br>A)$14,000<br>B)$15,000<br>C)$18,000<br>D)$24,000

Q235: Contribution margin and gross margin mean the

Q236: How much is the cost of goods

Q236: If the company marks up its unit

Q249: For financial reporting purposes, the total amount