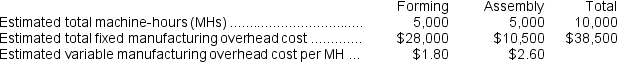

Merati Corporation has two manufacturing departments--Forming and Assembly. The company used the following data at the beginning of the year to calculate predetermined overhead rates:

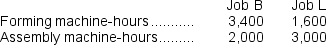

During the most recent month, the company started and completed two jobs--Job B and Job L. There were no beginning inventories. Data concerning those two jobs follow:

During the most recent month, the company started and completed two jobs--Job B and Job L. There were no beginning inventories. Data concerning those two jobs follow:

-Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments.The departmental predetermined overhead rate in the Assembly Department is closest to:

Definitions:

Profit-Maximizing Firm

A business entity whose primary goal is to achieve the highest possible profit from its operations.

Employ

The act of engaging individuals to perform tasks or services for compensation.

Land

In economics, this refers to all natural resources used to produce goods and services, including not just land itself but minerals, forests, and other resources.

NFL Teams

are professional football teams that are part of the National Football League, a major American football league consisting of 32 teams divided equally between the National Football Conference (NFC) and the American Football Conference (AFC).

Q52: The gross margin for December is:<br>A)$530,400<br>B)$227,700<br>C)$362,100<br>D)$1,421,100

Q101: The journal entry to record the allocation

Q120: Boward Corporation has two production departments, Milling

Q135: During June, Briganti Corporation purchased $79,000 of

Q195: Entry (4)in the below T-account could represent

Q214: Leelanau Corporation uses a job-order costing system.The

Q246: The amount of overhead applied to Job

Q252: The amount of manufacturing overhead that would

Q255: Fanelli Corporation, a merchandising company, reported the

Q292: In making the decision to buy the