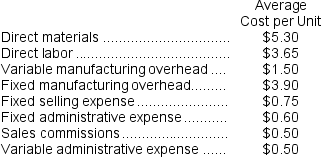

Saxbury Corporation's relevant range of activity is 3,000 units to 7,000 units.When it produces and sells 5,000 units, its average costs per unit are as follows:  Required:

Required:

a.For financial reporting purposes, what is the total amount of product costs incurred to make 5,000 units?

b.For financial reporting purposes, what is the total amount of period costs incurred to sell 5,000 units?

c.If 6,000 units are sold, what is the variable cost per unit sold?

d.If 6,000 units are sold, what is the total amount of variable costs related to the units sold?

e.If 6,000 units are produced, what is the average fixed manufacturing cost per unit produced?

f.If 6,000 units are produced, what is the total amount of fixed manufacturing cost incurred?

g.If 6,000 units are produced, what is the total amount of manufacturing overhead cost incurred? What is this total amount expressed on a per unit basis?

h.If the selling price is $22.90 per unit, what is the contribution margin per unit sold?

i.If 4,000 units are produced, what is the total amount of direct manufacturing cost incurred?

j.If 4,000 units are produced, what is the total amount of indirect manufacturing cost incurred?

k.What incremental manufacturing cost will the company incur if it increases production from 5,000 to 5,001 units?

Definitions:

Implementation Lag

The time delay between when a policy or economic strategy is decided upon and when it is actually put into effect.

Effectiveness Lag

The delay between the time a policy measure is implemented and the time the measure has its intended effect on the economy.

Activity Lag

The delay between the time a particular economic policy is enacted and the time when its full effects are observed in the economy.

Passive Policy

An economic policy approach that involves minimal intervention by the government in the economy, allowing market forces to operate without active guidance or stimulus.

Q8: A researcher performs a hypothesis test and

Q18: When researcher states that an observed value

Q34: The estimated total manufacturing overhead for the

Q40: The salary that Mark earns at his

Q45: You ask 5 people to indicate the

Q66: According to the central limit theorem,the mean

Q122: Random assignment is possible with<br>A)observational strategies only.<br>B)experimental

Q226: If 3,000 units are produced, the total

Q247: A direct cost is a cost that

Q257: If 5,000 units are sold, the total