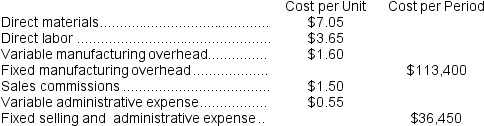

Dobosh Corporation has provided the following information:  Required:

Required:

a.For financial reporting purposes, what is the total amount of product costs incurred to make 9,000 units?

b.For financial reporting purposes, what is the total amount of period costs incurred to sell 9,000 units?

c.If 10,000 units are sold, what is the variable cost per unit sold?

d.If 10,000 units are sold, what is the total amount of variable costs related to the units sold?

e.If 10,000 units are produced, what is the total amount of manufacturing overhead cost incurred?

f.If the selling price is $21.60 per unit, what is the contribution margin per unit sold?

g.If 8,000 units are produced, what is the total amount of direct manufacturing cost incurred?

h.If 8,000 units are produced, what is the total amount of indirect manufacturing costs incurred?

i.What incremental manufacturing cost will the company incur if it increases production from 9,000 to 9,001 units?

Definitions:

Missionary Selling

A sales technique where the seller promotes their product by educating the customer on its benefits, often without directly pushing for a sale.

Intangible Products

Products that are not physical in nature, such as software, entertainment, or services, offering value through non-physical means.

Insurance

Contract by which the insurer for a fee agrees to reimburse the insured a sum of money if a loss occurs.

Q1: The sampling distribution of the mean contains<br>A)raw

Q11: If a researcher is interested in having

Q24: The ability to make a causal inference

Q38: Nonparametric statistics require quantitative dependent variables and

Q49: A researcher in sports psychology is interested

Q123: Type II errors are made when you

Q151: Paolucci Corporation's relevant range of activity is

Q174: The estimated total manufacturing overhead is closest

Q278: The estimated total manufacturing overhead for the

Q292: In making the decision to buy the