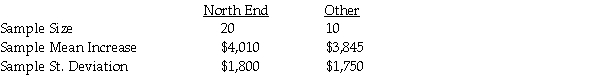

There have been complaints recently from homeowners in the north end claiming that their homes have been assessed at values that are too high compare with other parts of town.They say that the mean increase from last year to this year has been higher in their part of town than elsewhere.To test this,the assessor's office staff plans to select a random sample of north end properties (group 1) and a random sample of properties from other areas within the city (group 2) and perform a hypothesis test.The following sample information is available:  Assuming that the null hypothesis will be tested using an alpha level equal to 0.05,what is the value of the test statistic?

Assuming that the null hypothesis will be tested using an alpha level equal to 0.05,what is the value of the test statistic?

Definitions:

Schedule A

A form used in the U.S. to itemize deductions for taxes, including medical expenses, state and local taxes, and charitable contributions.

Personal Property Taxes

Taxes levied by local governments on the value of personal property such as vehicles, boats, and equipment.

FICA Taxes

Federal taxes required to be deducted from employees' wages for Social Security and Medicare, also paid in part by employers.

Adjusted Gross Income

The measure of one's taxable income, calculated as gross income minus allowable adjustments.

Q14: In a recent report to the supply

Q20: If the standard deviation for the sampling

Q28: There are a number of highly touted

Q29: Assume a sample of size n =

Q48: In a hypothesis test involving two population

Q65: In a test for determining whether two

Q72: When using the p-value method for a

Q81: What does the term expected cell frequencies

Q96: A population,with an unknown distribution,has a mean

Q113: Recently,a department store chain was interested in