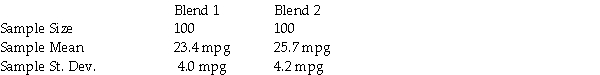

A major U.S.oil company has developed two blends of gasoline.Managers are interested in estimating the difference in mean gasoline mileage that will be obtained from using the two blends.As part of their study,they have decided to run a test using the Chevrolet Impala automobile with automatic transmissions.They selected a random sample of 100 Impalas using Blend 1 and another 100 Impalas using Blend 2.Each car was first emptied of all the gasoline in its tank and then filled with the designated blend of the new gasoline.The car was then driven 200 miles on a specified route involving both city and highway roads.The cars were then filled and the actual miles per gallon were recorded.The following summary data were recorded:  Based on these sample data,compute and interpret the 95 percent confidence interval estimate for the difference in mean mpg for the two blends.

Based on these sample data,compute and interpret the 95 percent confidence interval estimate for the difference in mean mpg for the two blends.

Definitions:

Activity-Based Costing

A costing method that assigns overhead and indirect costs to specific products or services based on the activities and resources that go into their production.

Direct Labor Cost

Refers to the total amount paid to workers directly involved in the production of goods or services, including wages and other related expenses.

Predetermined Overhead Rate

An estimated rate used to charge overhead costs to products or job orders, based on a selected allocation base anticipated before the accounting period.

Predetermined Overhead Rate

An estimated rate used to allocate manufacturing overhead costs to products based on a specific activity base.

Q1: Sampling error is the difference between a

Q9: In developing a scatter plot,the decision maker

Q15: In analyzing the sampling distribution of a

Q30: A major airline has stated in an

Q49: Employees at a large computer company earn

Q52: A researcher is using a chi-square test

Q62: The Bradfield Container Company makes "cardboard" boxes

Q88: The power of a test is measured

Q105: The number of cells in a two-factor

Q144: If we are interested in estimating the