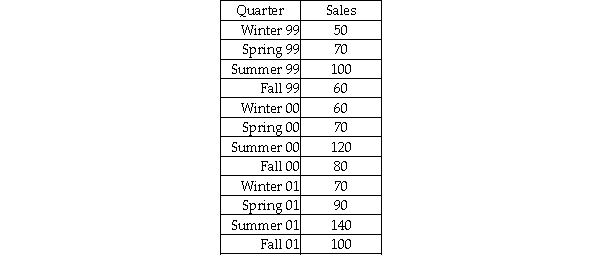

The Boxer Company has been in business since 1998.The following sales data are recorded by quarter for the years 1999-2001.  The managers at the company wish to determine the seasonal indexes for each quarter during the year.The first step in the process is to remove the seasonal and random components.To do this,they will begin by computing a four-period moving average.They then compute the centered moving average.What is the centered moving average for Spring '01?

The managers at the company wish to determine the seasonal indexes for each quarter during the year.The first step in the process is to remove the seasonal and random components.To do this,they will begin by computing a four-period moving average.They then compute the centered moving average.What is the centered moving average for Spring '01?

Definitions:

Dividend Yield

A ratio in finance that reveals the comparison between a company's yearly dividend distribution and its share price.

Required Return

Required Return is the minimum annual percentage earned by an investment that will induce individuals or companies to put their money into a particular security or project.

Stock Price

The cost of purchasing a share of a company as quoted on the stock exchange.

Dividend Growth Rate

The annualized percentage rate of growth of a company's dividend payments to its shareholders.

Q19: The goodness-of-fit test is always a one-tail

Q21: A stable process is one that has

Q30: A cell phone company wants to determine

Q31: In testing a hypothesis that two categorical

Q67: A correlation coefficient computed from a sample

Q70: A multiple regression is shown for a

Q87: In employing the Mann-Whitney U test,the sample

Q91: A survey was recently conducted in which

Q106: In a forward stepwise regression process,it is

Q111: Given a sample correlation r = -0.5