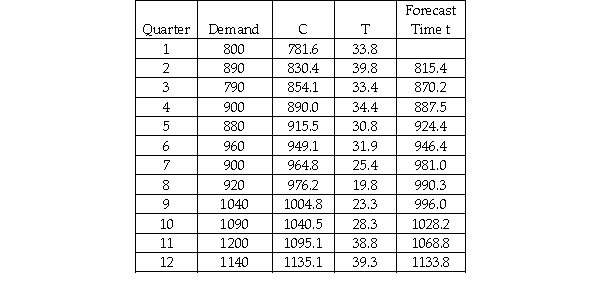

The Wilson Company is interested in forecasting demand for its XG-667 product for quarter 13 based on 12 quarters of data.The following shows the data and the double exponential smoothing model results for periods 1-12 using alpha = 0.20 and beta = 0.40.  Based on this information,what is the difference between the forecast for period 13 using smoothing constants of alpha = 0.20 and beta = 0.40 and smoothing constants of alpha = 0.10 and beta = 0.30? (Assume that the starting values for period 0 are C = 745 and T = 32.)

Based on this information,what is the difference between the forecast for period 13 using smoothing constants of alpha = 0.20 and beta = 0.40 and smoothing constants of alpha = 0.10 and beta = 0.30? (Assume that the starting values for period 0 are C = 745 and T = 32.)

Definitions:

Supply

The complete quantity of a product or service that can be bought at a particular price point.

Price Floor

A legally established minimum price for a good, or service. Normally set at a price above the equilibrium price.

Competitive Market

A market structure characterized by a large number of buyers and sellers, free entry and exit, and a high level of competition.

Persistent Shortages

An economic condition where the demand for a good or service consistently exceeds its supply, often due to factors like price controls, causing prolonged scarcity.

Q6: An investor has $1000 to invest and

Q23: The forecasting interval is the unit of

Q35: Closed-end investment companies typically sell additional shares

Q39: In a chi-square goodness-of-fit test,by combining cells

Q41: An annual time series cannot exhibit a

Q51: Nonmarketable financial assets that protect against inflation

Q70: A cell phone company wants to determine

Q81: Assume that you are conducting a small

Q108: If one or more of the regression

Q112: The following regression output is available.Notice that