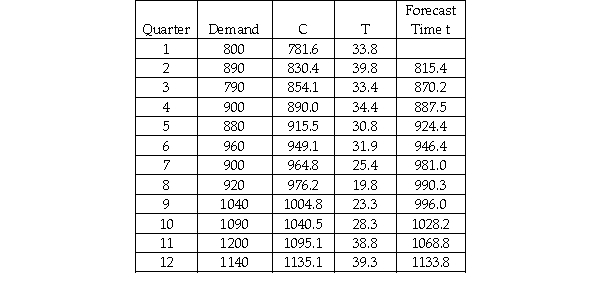

The Wilson Company is interested in forecasting demand for its XG-667 product for quarter 13 based on 12 quarters of data.The following shows the data and the double exponential smoothing model results for periods 1-12 using alpha = 0.20 and beta = 0.40.  Based on this information,which of the following statements is true?

Based on this information,which of the following statements is true?

Definitions:

Market Risk Premium

The supplementary income expected by investors when they choose to invest in a volatile market portfolio rather than in secure, riskless options.

Risk-Free Rate

The return on investment with zero risk, typically represented by yields on government securities.

Beta

A measure of a stock's volatility in relation to the overall market; a beta greater than 1 indicates the stock is more volatile than the market.

Unsystematic Risk

The type of risk that is specific to a company or industry, which can be minimized through diversification.

Q1: The par value of Blaze,Inc.common stock is

Q15: Under what circumstances does the variance inflation

Q24: How is the earnings retention rate related

Q26: Under what conditions should a decision maker

Q30: Good decisions always result in good outcomes.

Q31: Total Quality Management and Kaizen are consistent

Q53: Interest on bonds is typically paid:<br>A)monthly<br>B)quarterly<br>C)semiannually<br>D)annually

Q56: A bakery makes fresh donuts every morning.If

Q58: If a decision maker wishes to develop

Q86: The goodness of test is essentially determining