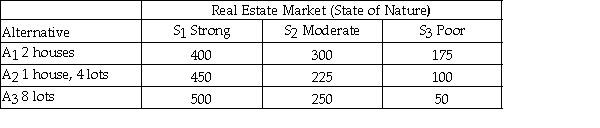

Buy 8 empty lots. At the end of 5 years you plan to sell all the real estate and you expect both houses and lots to appreciate in value.Owning and renting out houses will also provide rental income,but there will also be expenses such as repairs and insurance that would not be involved for empty lots.The amount of appreciation depends on the real estate market that you expect to be one of the three levels shown in the table below along with the expected payoff values (shown in thousands of dollars) .  Assume that you estimate the following probabilities for the states of the real estate market:

Assume that you estimate the following probabilities for the states of the real estate market:  Based on the expected value criterion you should choose alternative:

Based on the expected value criterion you should choose alternative:

Definitions:

Machine-Hours

A measure of production time, referring to the number of hours machines are run to produce goods.

Oil Well Service Company

An oil well service company provides a range of services to the oil and gas industry, including drilling, maintenance, and completion services for oil wells.

Flexible Budget

A budget that adjusts or flexes with changes in volume or activity levels during a period.

Planning Budget

A budget that outlines the expected revenues, expenses, and resource allocations over a specific period, used for strategic financial planning.

Q6: Consider the situation in which a study

Q9: TIPS adjust for inflation by adjusting the

Q16: Specialists often sell short to meet public

Q17: It is not important to have a

Q39: In the case of a corporate bankruptcy,bondholders

Q40: Which of the following is the best

Q47: NYSE Specialists are required to<br>A)maintain a bid-ask

Q47: In a double smoothing model,large values for

Q51: If an analyst uses ex post data

Q52: A claim was recently made that stated