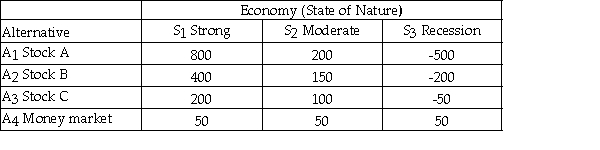

An investor has $1000 to invest and is considering the four alternatives shown below.How well each investment does depends on the state of the economy.The payoff table is shown below.  Based on the minimax regret criterion,which investment should be chosen?

Based on the minimax regret criterion,which investment should be chosen?

Definitions:

Uncovered Interest Parity

A financial theory that suggests interest rate differentials between two countries will be equal to the expected change in exchange rates between their currencies.

Exchange Rate

The value of one currency for the purpose of conversion to another, which fluctuates based on market conditions and impacts international trade and investments.

British Pounds

The official currency of the United Kingdom, also known as GBP (Great Britain Pound).

Swiss Francs

The official currency of Switzerland and Liechtenstein, known for its strength and stability as a global finance indicator.

Q6: An investor has $1000 to invest and

Q6: Smaller companies with fewer publicly held shares

Q12: Normal stock exchange hours in the U.S.are

Q14: Which of the following limits the usefulness

Q21: Define risk in the context of investments?

Q43: Technically,investments include:<br>A)only financial assets.<br>B)only marketable assets.<br>C)financial and

Q60: The Boxer Company has been in business

Q76: Which of the following is the difference

Q81: Philip Crosby claimed that quality is free

Q99: Payoff refers to the net profit or