-Which statement is false?

Definitions:

CCA Class

Refers to categories in the Capital Cost Allowance system where assets are grouped according to their nature and function for tax depreciation purposes in Canada.

Annual Depreciation Tax Shield

This represents the tax savings a company achieves due to depreciation expense, calculated as the depreciation times the tax rate.

Tax Rate

The percentage at which an individual or corporation is taxed, which can vary based on income level, jurisdiction, and type of tax.

Straight-Line Depreciation

A method for portioning out the cost of a hard asset over its service life in consistent yearly values.

Q24: Which statement is the most accurate?<br>A)Usury laws

Q29: Collective bargaining involves negotiations over<br>A)pay.<br>B)working conditions.<br>C)fringe benefits.<br>D)All

Q34: Most of the women with children on

Q68: The demand for "givebacks" by employers became

Q74: The present value of a dollar received

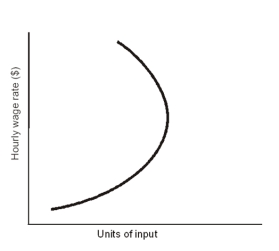

Q100: An auto service station has four mechanics.If

Q155: All other things staying the same,an increase

Q173: _ are an example of a bilateral

Q174: The theory that profits are a reward

Q257: Compared to the poverty rate for blacks,the