-Which statement is true?

Definitions:

Deferral

Recognition of revenue or expenses in a period different from when the transaction actually occurred, usually related to prepaid expenses or unearned revenue.

Recognition

Recognition in accounting refers to the formal acknowledgment of a transaction or event in the financial statements, often involving the recording of revenue or expense.

Expense

Costs incurred by a business in the process of earning revenues.

Deferral Adjusting Entry

An accounting entry made to defer revenue or expense to a future period.

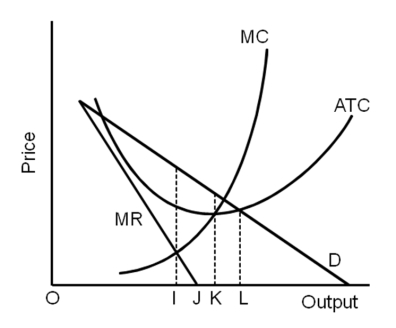

Q49: When a firm is maximizing profits it

Q51: A _ merger takes place when a

Q56: If the monopolist can sell 10 units

Q64: The deregulation of a few major industries

Q87: The first antitrust act passed was the

Q113: Which statement is false?<br>A)A few decades ago

Q146: Which statement is true?<br>A)Most oligopolies in the

Q165: If perfect competitors are losing money in

Q275: Profit per unit is<br>A)TF.<br>B)TG.<br>C)SH.<br>D)GF.

Q361: A return above implicit and explicit costs