-Which statement is true?

Definitions:

Tax Rate

The percentage at which an individual or corporation is taxed.

Depreciable Non-Current Asset

A long-term asset subject to depreciation, which systematically reduces its book value over its useful life to account for wear and tear.

NCI Share

NCI Share refers to Non-Controlling Interest share, which is the portion of equity in a subsidiary not attributable directly or indirectly to the parent company.

Useful Life

The estimated period over which a tangible asset is expected to be usable by the entity, affecting its amortization or depreciation rate.

Q22: At an output of 4,MC= $9,ATC =

Q34: Total profit (or loss)<br>A)is the rectangle bounded

Q67: If a person wishes to maximize their

Q109: If the price of milk shakes was

Q158: Statement I: Average variable cost can be

Q166: To determine if a firm is operating

Q210: If a monopolist's marginal cost equals its

Q223: At an output of 4,AFC is<br>A)$50.<br>B)$100.<br>C)$200.<br>D)$400.<br>E)cannot be

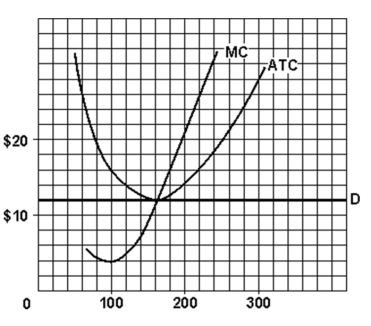

Q246: How much is the firm's output at

Q344: Label the shutdown point.