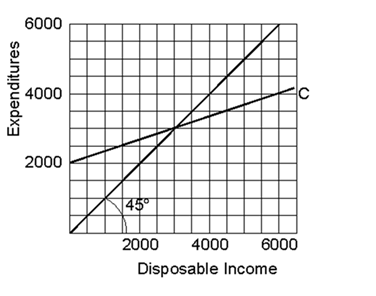

-How much is the MPC?

Definitions:

Regressive Tax

A tax imposed in such a manner that the tax rate decreases as the amount subject to taxation increases, disproportionately affecting those with lower incomes.

Social Security Tax

A payroll tax collected to fund the Social Security program, charged to both employers and employees.

Sales Tax

A tax imposed by a government on sales of goods and services, collected by the retailer and passed on to the state or local government.

Proportional Rate Structure

A tax system where the tax rate is the same for all income levels, meaning everyone pays the same percentage of their income in taxes, regardless of how much they earn.

Q40: An increase in demand occurs when<br>A)quantity demanded

Q103: Statement I: Karl Marx would have approved

Q153: Which of the following statements is false?<br>A)Critics

Q174: Which statement is false?<br>A)A demand curve slopes

Q210: When disposable income is 2,000,how much is

Q222: In a capitalistic economic system,who owns most

Q230: Which of the following government programs will

Q236: How much is saving?

Q294: When disposable income is 3,000,the APC is

Q308: The term "conspicuous consumption" was coined by