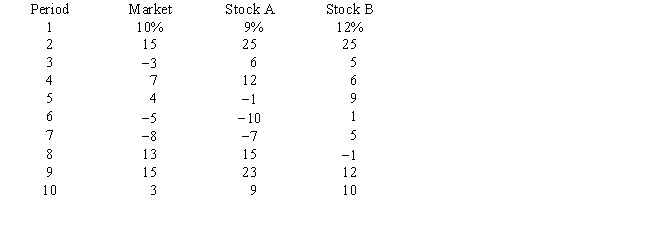

(This problem illustrating the computation of beta coefficients may be solved using the Investment Analysis Calculator or Excel.)The returns on the market and stock A and stock B are as follows:

Compute the beta coefficient for each stock and interpret the results of the computations.

Compute the beta coefficient for each stock and interpret the results of the computations.

Definitions:

Net Realizable Value

The estimated selling price of an asset in the ordinary course of business minus any costs associated with its sale or disposal.

Aging Method

An accounting technique used to estimate uncollectible accounts receivable based on the age of each account's outstanding invoices.

Direct Write-off

The Direct Write-off method is an accounting procedure where uncollectible debts from customers are directly written off against income at the time they are deemed uncollectible.

Bad Debts Recovered

Amounts previously written off as uncollectible but later received or recovered, leading to an adjustment in the financial statements.

Q2: According to behavioral finance,investors often select investment

Q3: Preferred stock pays a fixed amount of

Q9: Given the following information:<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4881/.jpg" alt="Given

Q9: Holding period returns for greater than a

Q19: If an investor purchases shares in a

Q21: The statement of cash flow places emphasis

Q30: If a closed-end investment company is selling

Q52: One advantage to the issuing firm of

Q61: Jane,marketing manager at Oh,Baby!,a professional preschool center,thinks

Q66: A firm with a selling orientation assumes