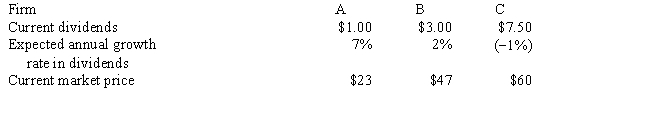

As an investor you have a required rate of return of 14 percent for investments in risky stocks.You have analyzed three risky firms and must decide which (if any)to purchase.Your information is

a.What is the maximum price? Which (if any)should you buy?

b.If you bought Stock A,what is your implied rate of return?

c.If your required rate of return were 10 percent,what should be the price necessary to induce you to buy Stock A?

Definitions:

Form S-3

Form S-3 is a regulatory filing used by publicly traded companies in the United States to provide updated or annual information to investors, utilized for simplified security offerings.

S-1

A registration statement filed with the U.S. Securities and Exchange Commission used by companies planning on going public to register their securities.

Forms

Various types or categories of documents designed for recording information according to a specific format or structure.

Filing

The process of submitting documents officially to a designated authority or organization, often used in the context of legal, tax, or regulatory documents.

Q1: Serial bonds<br>A) have a sinking fund<br>B) are

Q12: For diversification to reduce risk,<br>A) the returns

Q13: The Clean-O Company makes an all-purpose cleaner

Q18: Stock indices do not consider taxes on

Q20: Dividend reinvestment plans offer which advantages?<br>1)deferment of

Q24: Bondholders are concerned with the firm's operating

Q28: Portfolio risk is the summation of business

Q39: A fallen angel is<br>A) a quality bond

Q50: Stockholders in a publicly held corporation have

Q56: The concept of duration stresses when a