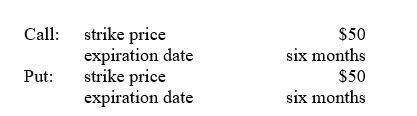

A put and a call have the following terms:

The price of the stock is currently $55.The price of the call and put are,respectively,$9 and $1.What will be the profit from buying the call or buying the put if,after six months,the price of the stock is $40,$50,or $60?

The price of the stock is currently $55.The price of the call and put are,respectively,$9 and $1.What will be the profit from buying the call or buying the put if,after six months,the price of the stock is $40,$50,or $60?

Definitions:

Bond Premium

The amount by which the market price of a bond exceeds its face value, typically resulting when market interest rates are lower than the bond's coupon rate.

Interest Expense

The cost incurred by an entity for borrowed funds, reflecting the interest payments on debt obligations.

Operating Line

A revolving credit facility extended by a bank to a business to fund its day-to-day operations.

Notes Payable

Debt instruments or formal written agreements to pay a specified sum of money at a future date.

Q11: When interest rates rise,the price of a

Q14: If a $100 par value preferred stock

Q14: Which one of the following is a

Q16: Real estate investment trusts (REITs)are illustrative of

Q17: Stock index options permit investors to establish

Q20: Dividend reinvestment plans offer which advantages?<br>1)deferment of

Q30: An identification of police officers by rank

Q54: The value of a put is inversely

Q61: The value of a bond depends on

Q75: Which of the following graphs is used