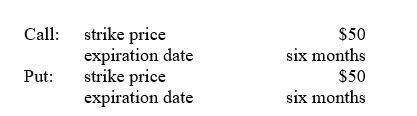

A put and a call have the following terms:

The price of the stock is currently $55.The price of the call and put are,respectively,$9 and $1.What will be the profit from buying the call or buying the put if,after six months,the price of the stock is $40,$50,or $60?

The price of the stock is currently $55.The price of the call and put are,respectively,$9 and $1.What will be the profit from buying the call or buying the put if,after six months,the price of the stock is $40,$50,or $60?

Definitions:

Economic Life

The estimated period over which an asset is expected to be useful in generating revenue or its intended purpose.

Carrying Value

The recorded value of an asset in a company's financial statements, taking into account depreciation, amortization, and impairment costs.

Bonds

Debt securities issued by entities (such as corporations or governments) to raise capital, promising to pay back the principal amount along with interest.

Interest Payable

The amount of interest expense that has been incurred but not yet paid by a company, often reflected as a liability on the balance sheet.

Q2: Convertible preferred stock is usually less risky

Q13: What is the range?<br>A)0.026<br>B)0.052<br>C)0.580<br>D)0.1613<br>E)0.0007

Q24: The market consists of the following stocks.Their

Q30: In general,income bonds are less risky than<br>A)

Q43: Activity ratios measure<br>A) how rapidly assets flow

Q45: Degree program entrance exam scores,such as MCAT

Q50: The time premium paid for an option

Q70: A bond is more likely to be

Q91: What is the first quartile?<br>A)0.752<br>B)0.552<br>C)0.85<br>D)0.8425<br>E)0.57

Q211: What are the inner fences?<br>A)4,11<br>B)8.5,9.5<br>C)5.5,9.5<br>D)10,9.5<br>E)5.5,10