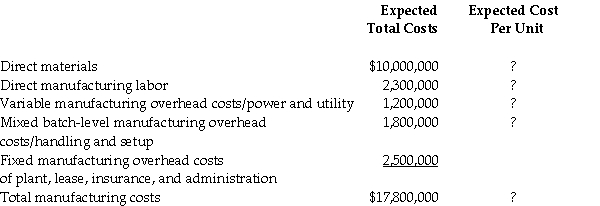

The Channel Company manufactures television remotes for new flat screen televisions.The Brighton Manufacturing Company offered to sell Channel Company 260,000 units to program the remotes next year at $54 per unit.The managerial accountant reported the following expected costs:

Required:

Compute the expected cost per unit in each category to produce 260,000 units next year and the total expected cost per unit.Does the manager at the Channel Company have enough information to accept or decline the offer from the manager at Brighton Manufacturing Company? Why or why not?

Definitions:

Compensation

Payment or benefits provided to employees in exchange for their services or to make amends for loss or injury.

Sales Commissions

Payments made to sales personnel, often calculated as a percentage of the sales they generate.

Unethical Sales Practices

Business methods that are deceptive, manipulative, or otherwise morally dubious, aimed at persuading customers to make purchases.

CEO's Salaries

The compensation awarded to chief executive officers of corporations, often comprising a mix of salary, bonuses, shares, and other benefits.

Q2: The Hobby Shop,a manufacturer of toy airplanes,experienced

Q6: The manager at the Alexandria Environmental Services

Q16: Setup costs never depreciation and maintenance costs

Q20: Managers use computer programs to prepare pareto

Q30: Seedem Manufacturing was approached by the international

Q58: What is the option feature of R&D

Q66: Target annual operating income divided by invested

Q67: Which of the following is not included

Q67: The cost function y = 40 +

Q71: _-cost allocation is arbitrary and mangers generally