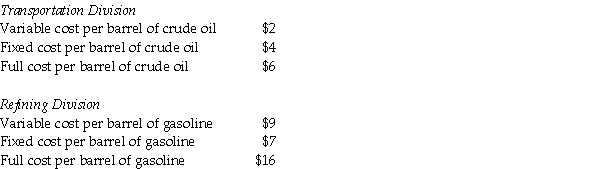

Mega Petroleum has two divisions,each operating as a profit center.The transportation division purchases crude oil in Venezuela,and transports it from Venezuela to Chicago,Illinois.The reefing division process crude oil into gasoline.The cost-based transfer price is 106% of full cost.The contract price of $75 per barrel of crude oil is based on market price in Chicago.The market price per barrel of crude oil supplied to the refining division is $90.The managerial accountant reported the following information?

Required

Compute the cost-based transfer prices at 106% of full cost of the crude oil purchased in Venezuela,plus the transportation division's variable and fixed costs.

Definitions:

Self-Blame

The act of attributing personal failures or negative events to one's own deficiencies or actions.

Coping Strategy

A method or technique used to manage or overcome demands and conflicts in life.

Repression

The unconscious exclusion of painful impulses, desires, or fears from the conscious mind.

Denial

A psychological defense mechanism where an individual refuses to accept reality or facts, often as a way to protect themselves from uncomfortable feelings.

Q6: Using activity-based cost drivers provide additional and

Q18: On its December 31st balance sheet,LCG Company

Q20: Which of the following methods either requires

Q35: In which step of the five-step decision-making

Q39: Monique's Gas-n-Go is considered to have a

Q55: What is the concept of the bottom-up

Q95: What causes the initial method of calculating

Q98: Which of the following is not true

Q103: Why do managers want to use a

Q110: The measure of the actual result deducted