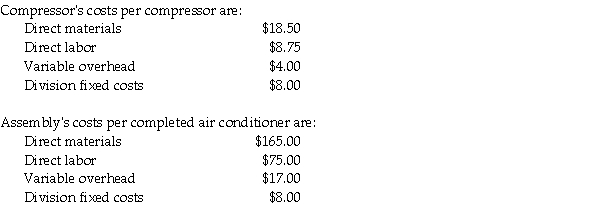

Scuba Tank Company manufactures only one type of oxygen tank;and,it has two divisions,the Compressor Division,and the Assembly Division.The Compressor Division manufactures compressors for the Assembly Division,which completes the oxygen tanks and sells it to retailers.The Compressor Division "sells" compressors to the Assembly Division.The market price for the Assembly Division to purchase a compressor is $41.50.(Ignore changes in inventory. ) The fixed costs for the Compressor Division are assumed to be the same over the range of 6,000-9,000 units.The fixed costs for the Assembly Division are assumed to be $8.00 per unit at 9,000 units.

Required

Compute the transfer price per compressor from the Compressor Division to the Assembly Division if the method used to place a value on each compressor is 160% of variable costs.Compute the transfer price per compressor from the Compressor Division to the Assembly Division if the transfer price per compressor is 125% of full costs.Next,assume the transfer price for a compressor is 135% of total costs of the Compressor Division and 1,250 of the compressors are produced and transferred to the Assembly Division,and compute the Compressor Division's operating income.Compute the operating income of the Compressor Division and the Assembly Division if the Assembly Division sells 1,250 oxygen tanks at a price of $395.50 per oxygen tank.

Definitions:

Competitive Firm

A business that operates in a market with many buyers and sellers, where no single entity can significantly influence the market price of goods and services.

Marginal Product

The additional output that results from using one more unit of a particular input, holding all other inputs constant.

Quantity of Land

The total amount of land available for use or development, within a specific area, which can impact agricultural, industrial, and residential development.

Marginal Product

The extra production gained by adding one more unit of a specific input while keeping all other inputs unchanged.

Q7: Why does the opportunity cost guideline measure

Q10: The term multinational corporation is used to

Q19: Which of the following is an example

Q31: Which of the following is not a

Q37: How do gains in the learning-and-growth perspective

Q37: Your lease calls for payments of $500

Q49: Gains or losses on the sale of

Q53: The most frequent budget period is one

Q81: Sarah is thinking about purchasing an investment

Q91: Decentralization speeds decision making,creating a competitive advantage