CAPM Analysis

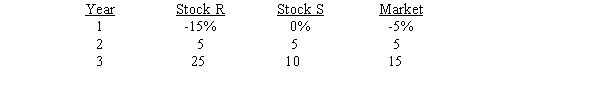

You have been asked to use a CAPM analysis to choose between stocks R and s, with your choice being the one whose expected rate of return exceeds its required rate of by the widest margin. The risk-free rate is 6%, and the required return on an average stock (or "the market") is 10%. Your security analyst tells you that Stock S's expected rate of return is = 11%, while Stock R's expected rate of return in = 13%. The CAPM is assumed to be a valid method for selecting stocks, but the expected return for any given investor (such as you) can differ from the required rate of return for a given stock. The following past rates of return are to be used to calculate the two stocks' beta coefficients, which are then to be used to determine the stocks' required rates of return.

Note: The averages of the historical returns are not needed, and they are generally not equal to the expected future returns.

Note: The averages of the historical returns are not needed, and they are generally not equal to the expected future returns.

-Refer to CAPM Analysis.Set up the SML equation and use it to calculate both stocks' required rates of return,and compare those required returns with the expected returns given above.You should invest in the stock whose expected return exceeds its required return by the widest margin.What is the widest margin,or greatest excess return r-r?

Definitions:

Medicaid

A government program in the United States providing health care coverage to individuals and families with low income and resources.

Healthcare Expenditures

The total amount of money spent on health services, medications, and other health-related items by individuals, health insurance companies, and governments.

Third Party

An independent entity involved in a transaction that is not the principal buyer or seller, often providing services or mediation.

Healthcare Expenditures

The total amount spent on health services, medications, and public health activities, typically measured over a specific period.

Q8: You just graduated,and you plan to work

Q19: You are the owner of 100 bonds

Q24: The net float is the difference between

Q26: A high current ratio insures that a

Q43: If Boyd Corporation has sales of $2

Q45: Since 70 percent of preferred dividends received

Q59: The last dividend on Spirex Corporation's common

Q72: Bonds issued by BB&C Communications that have

Q93: The stand-alone risk is the risk an

Q99: A contract negotiated directly with a bank