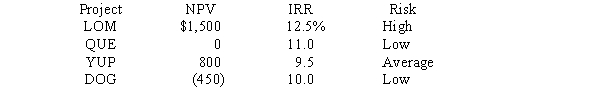

A college intern working at Anderson Paints evaluated potential investments-that is,capital budgeting projects-using the firm's average required rate of return (WACC) ,and he produced the following report for the capital budgeting manager:  The capital budgeting manager usually considers the risks associated with capital budgeting projects before making her final decision.If a project has a risk that is different from average,she adjusts the average required rate of return by adding or subtracting 2 percentage points.If the four projected listed above are independent,which one(s) should the capital budgeting manager recommend be purchased?

The capital budgeting manager usually considers the risks associated with capital budgeting projects before making her final decision.If a project has a risk that is different from average,she adjusts the average required rate of return by adding or subtracting 2 percentage points.If the four projected listed above are independent,which one(s) should the capital budgeting manager recommend be purchased?

Definitions:

Proportions

A statistical measure that represents the size of part of a whole, typically expressed as a fraction or percentage.

Proportion of Female Managers

The ratio or percentage of managerial positions held by women in a given organization or sector.

Conclusion

The end or finish of an event, process, or text, often summarizing findings or results.

Power Curve

A graphical representation used in statistics to show the probability of rejecting the null hypothesis at various effect sizes.

Q9: Mooradian Corporation estimates that its required rate

Q16: Sea Sport Boat Corporation currently has a

Q23: Managers,on average,do not raise dividends unless they

Q33: You have recently accepted a one-year employment

Q34: The two reasons most experts give for

Q39: Two projects being considered are mutually exclusive

Q45: Although the payback method ignores the time

Q52: The after tax cost of debt is

Q53: An annuity is a series of equal

Q53: Due to a number of lawsuits related