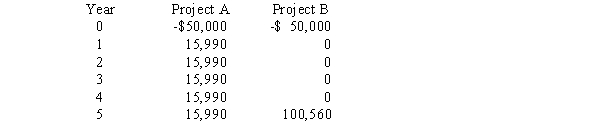

Two projects being considered are mutually exclusive and have the following projected cash flows:  At what rate (approximately) do the NPV profiles of Projects A and B cross?

At what rate (approximately) do the NPV profiles of Projects A and B cross?

Definitions:

Net Present Value

Net Present Value (NPV) is a financial metric used to evaluate the profitability of an investment or project, calculated as the difference between the present value of cash inflows and outflows.

Q9: The average cash conversion cycle of European

Q9: The expected rate of return of an

Q12: Which of the following is considered an

Q23: The facilities needed to conduct over-the-counter market

Q26: Which of the following statements is correct?<br>A)

Q33: Synchronization of cash flows is an important

Q35: Your company is considering a machine which

Q40: The "new stock" type of dividend reinvestment

Q54: Given the following information,calculate the expected capital

Q58: Capital budgeting decisions must be based on