Multiple Choice

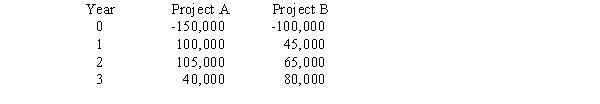

Woodson Inc.has two possible projects,Project A and Project B,with the following cash flows:  At what required rate of return do the two projects have the same net present value (NPV) ? (In other words,what is the "crossover rate" of the projects' NPV profiles?)

At what required rate of return do the two projects have the same net present value (NPV) ? (In other words,what is the "crossover rate" of the projects' NPV profiles?)

Definitions:

Related Questions

Q5: Houston Inc.is considering a project which involves

Q5: Devine Divots issued a bond a few

Q22: As a rule,managers should try to always

Q25: What is the future value of a

Q28: You are given the following data: <img

Q35: Refer to Gargoyle Unlimited.What is the dollar

Q38: Refer to East Lansing Appliances.What are the

Q45: Meals on Wings Inc.supplies prepared meals for

Q90: A call provision gives bondholders the right

Q96: A lockbox plan is<br>A) A method for