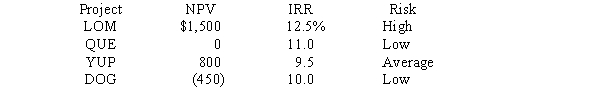

A college intern working at Anderson Paints evaluated potential investments-that is,capital budgeting projects-using the firm's average required rate of return (WACC) ,and he produced the following report for the capital budgeting manager:  The capital budgeting manager usually considers the risks associated with capital budgeting projects before making her final decision.If a project has a risk that is different from average,she adjusts the average required rate of return by adding or subtracting 2 percentage points.If the four projected listed above are independent,which one(s) should the capital budgeting manager recommend be purchased?

The capital budgeting manager usually considers the risks associated with capital budgeting projects before making her final decision.If a project has a risk that is different from average,she adjusts the average required rate of return by adding or subtracting 2 percentage points.If the four projected listed above are independent,which one(s) should the capital budgeting manager recommend be purchased?

Definitions:

IRR

Stands for Internal Rate of Return, a financial metric used to estimate the profitability of potential investments.

MIRR

The Modified Internal Rate of Return, which adjusts the IRR for the cost of capital and provides a better indication of a project's efficiency and profitability.

IRR

Internal Rate of Return; a metric in finance that helps in calculating the expected profitability of prospective investments.

Cash Flow

The total amount of money being transferred into and out of a business, affecting the company's liquidity.

Q1: Expansion project analysis requires determining the amount

Q12: When management controls more than 50% of

Q17: Firms following a restricted current asset policy

Q18: You have a chance to purchase a

Q20: Bell Brothers has $3,000,000 in sales.Its fixed

Q22: Selzer Inc.sells all its merchandise on credit.It

Q34: Refer to Copybold Corporation.What is the coefficient

Q48: Refer to Rollins Corporation.What is Rollins' cost

Q53: The only condition under which risk can

Q78: Refer to Copybold Corporation.What is the coefficient