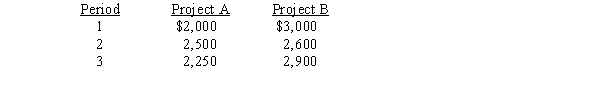

Real Time Systems Inc.is considering the development of one of two mutually exclusive new computer models.Each will require a net investment of $5,000.The cash flow figures for each project are shown below:  Model B,which will use a new type of laser disk drive,is considered a high-risk project,while Model A is of average risk.Real Time adds 2 percentage points to arrive at a risk-adjusted discount rate when evaluating a high-risk project.The rate used for average risk projects is 12 percent.Which of the following statements regarding the NPVs for Models A and B is most correct?

Model B,which will use a new type of laser disk drive,is considered a high-risk project,while Model A is of average risk.Real Time adds 2 percentage points to arrive at a risk-adjusted discount rate when evaluating a high-risk project.The rate used for average risk projects is 12 percent.Which of the following statements regarding the NPVs for Models A and B is most correct?

Definitions:

Primary Aging

The gradual, inevitable process of physical decline that occurs throughout life, regardless of health practices.

Functional

Designed to be practical and useful, rather than solely attractive.

Secondary

Refers to the second level or stage in a series or a process, often used in education to describe schools for students aged approximately 11 to 18.

Life Expectancy

The average period that an individual is expected to live, often calculated from birth, based on a number of factors including historical data, current age, and health status.

Q7: If you buy a bond that is

Q8: Which of the following investments is not

Q13: Dixie Tours Inc.buys on terms of 2/15,net

Q25: NPV and IRR will always lead to

Q34: The beta risk of a project is

Q53: The benefit to the firm of the

Q60: A promissory note is a document specifying

Q84: If the firm is being operated so

Q86: One implication of the signaling theory of

Q89: Trade credit can be separated into two