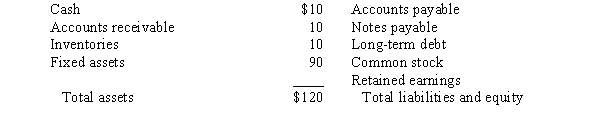

A firm has the following balance sheet:  Fixed assets are being used at 80 percent of capacity; sales for the year just ended were $200; sales will increase $10 per year for the next 4 years; the profit margin is 5 percent; and the dividend payout ratio is 60 percent.Assume that fixed assets cannot be sold.What are the total external financing requirements for the entire 4 years,i.e.,the total AFN for the 4-year period?

Fixed assets are being used at 80 percent of capacity; sales for the year just ended were $200; sales will increase $10 per year for the next 4 years; the profit margin is 5 percent; and the dividend payout ratio is 60 percent.Assume that fixed assets cannot be sold.What are the total external financing requirements for the entire 4 years,i.e.,the total AFN for the 4-year period?

Definitions:

Degrees of Freedom

The number of independent pieces of information available to estimate another parameter.

Expected Frequencies

The anticipated count of occurrences across different categories based on probability distributions in statistics.

Chi-Square Value

A statistical measure used in tests of independence and goodness of fit, indicating how expectations compare to actual observed data.

Degrees of Freedom

Degrees of freedom refer to the number of independent values or quantities that can vary in an analysis without breaking any constraints.

Q4: Under the terms of trade found in

Q16: Jyl,a supervisor,told her employees,"The store will close

Q17: Reward power results from managers' authority to

Q19: Do not use the approximation formula for

Q26: Which of the following might be attributed

Q37: If the Modigliani and Miller hypothesis about

Q51: The majority of workplace learning is informal.

Q55: Compuvac Company has just completed its first

Q56: A commitment fee is a fee charged

Q82: Which of the following is a tip