Lintner Beverage Corp.reported the following information from their financial statements:

Operating income (EBIT) = $20,000,000

Interest payments on long-term debt = $1,750,000

Dividend income = $1,000,000

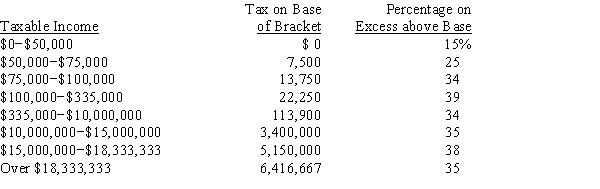

Calculate Lintner's total tax liability using the corporate tax schedule below:

Definitions:

Regressive Tax

A tax imposed in such a manner that the tax rate decreases as the amount subject to taxation increases, disproportionately impacting those with lower incomes.

Tax Revenues

The money that governments procure from tax collection.

Local Governments

Administrative bodies in smaller geographical areas within a country that govern at a level below that of the state or federal government.

Expenditures

Expenditures are the expenses incurred by individuals, businesses, or governments in paying for goods and services.

Q3: Paul,who is normally an ethical person,has an

Q17: Which of the following statements is CORRECT?<br>A)Other

Q24: _ guides the justice approach to deciding

Q42: Which of the following is an example

Q45: Mr.Smythe,a wealthy businessman who made his fortune

Q45: Ryngaert Inc.recently issued noncallable bonds that mature

Q52: Gregson Production is keenly aware of the

Q57: If the pure expectations theory holds,which of

Q64: Which of the following statements is CORRECT?<br>A)Two

Q163: What is the PV of an ordinary