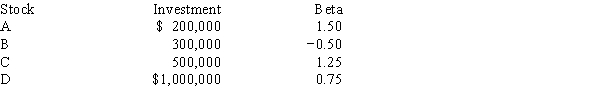

Consider the following information and then calculate the required rate of return for the Global Investment Fund,which holds 4 stocks.The market's required rate of return is 13.25%,the risk-free rate is 7.00%,and the Fund's assets are as follows:

Definitions:

Restraining Forces

Factors that hinder or slow down the process of organizational change, including employee resistance, inadequate resources, and poor communication.

Driving Forces

Driving forces are factors that push in a direction that causes change or influence events.

Change Agents

Individuals or entities that act as catalysts for change within an organization, driving and facilitating change efforts.

Subtle Forms

Indirect or not immediately obvious ways in which something can manifest or be expressed.

Q4: Refer to Exhibit 4.1.What is the firm's

Q4: Goode Inc.'s stock has a required rate

Q16: Tucker Corporation is planning to issue new

Q36: Which of the following rules is CORRECT

Q49: During periods when inflation is increasing,interest rates

Q65: Charter Bank pays a 4.50% nominal rate

Q65: Provided a firm does not use an

Q67: Which of the following statements is CORRECT?<br>A)The

Q105: The primary reason that the NPV method

Q122: Carson Inc.'s manager believes that economic conditions